Content

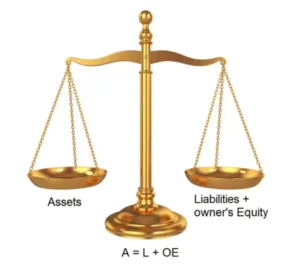

When an economic event — such as a sale to a customer or receipt of a vendor’s invoice — occurs, it is measured in terms of its monetary value. The total debit entries in the trial balance are then compared to the total credit entries to ensure the amounts are equal prior to reporting the transactions in financial statements. It gives meaning to the balance sheet structure and is the foundation of double-entry accounting.

Locate the company’s total assets on the balance sheet for the period. The shareholders’ equity number is a company’s total assets minus its total liabilities. This equation sets the foundation of double-entry accounting, also known as double-entry bookkeeping, and highlights the structure of the balance sheet. Double-entry accounting is a system where every transaction affects at least two accounts. From the Statement of Stockholders’ Equity, Alphabet’s share repurchases can be seen. Their share repurchases impact both the capital and retained earnings balances.

The Accounting Equation

This transaction increases the company’s assets, specifically cash, by $15,000 and increases owner’s equity by $15,000. This increases the fixed assets account and increases the accounts payable account.

As a result, only the https://www.bookstime.com/ and liabilities elements of the basic accounting equation are affected by the transaction. In this instance, both the assets and liabilities are decreased, while the owner’s equity remains unchanged. Utility payments are generated from bills for services that were used and paid for within the accounting period, thus recognized as an expense. The decrease to assets, specifically cash, affects the balance sheet and statement of cash flows.

Determination of the debit and credit using the expanded accounting equation.

The Accounting Equation Techniques equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. Below are examples of items listed on the balance sheet. This straightforward relationship between assets, liabilities, and equity is considered to be the foundation of the double-entry accounting system. The accounting equation ensures that the balance sheet remains balanced.

A Beginner’s Guide to Double-Entry Accounting – The Motley Fool

A Beginner’s Guide to Double-Entry Accounting.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

In order to understand the accounting equation, you have to understand its three parts. Good examples of assets are cash, land, buildings, equipment, and supplies. Money that is owed to a company by its customers, which is known as accounts receivable, is also an asset. The purchased office equipment will increase Assets by $500 and decrease them by $250 . On the left side of the basic accounting equation, an increase of $250 is balanced by an increase of $250 on the right side of the equation for liabilities . A company’s liabilities include every debt it has incurred. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses.

ACCOUNTING FORMULAS: THE 5 MOST IMPORTANT

Thus, the asset and liability sides of the transaction are equal. Purchasing refers to a business or organization acquiring goods or services to accomplish the goals of its enterprise. This transaction results in a decrease in the finances of the purchaser and an increase in the benefits of the sellers. As credit purchases are made, accounts payable will increase.