Contents

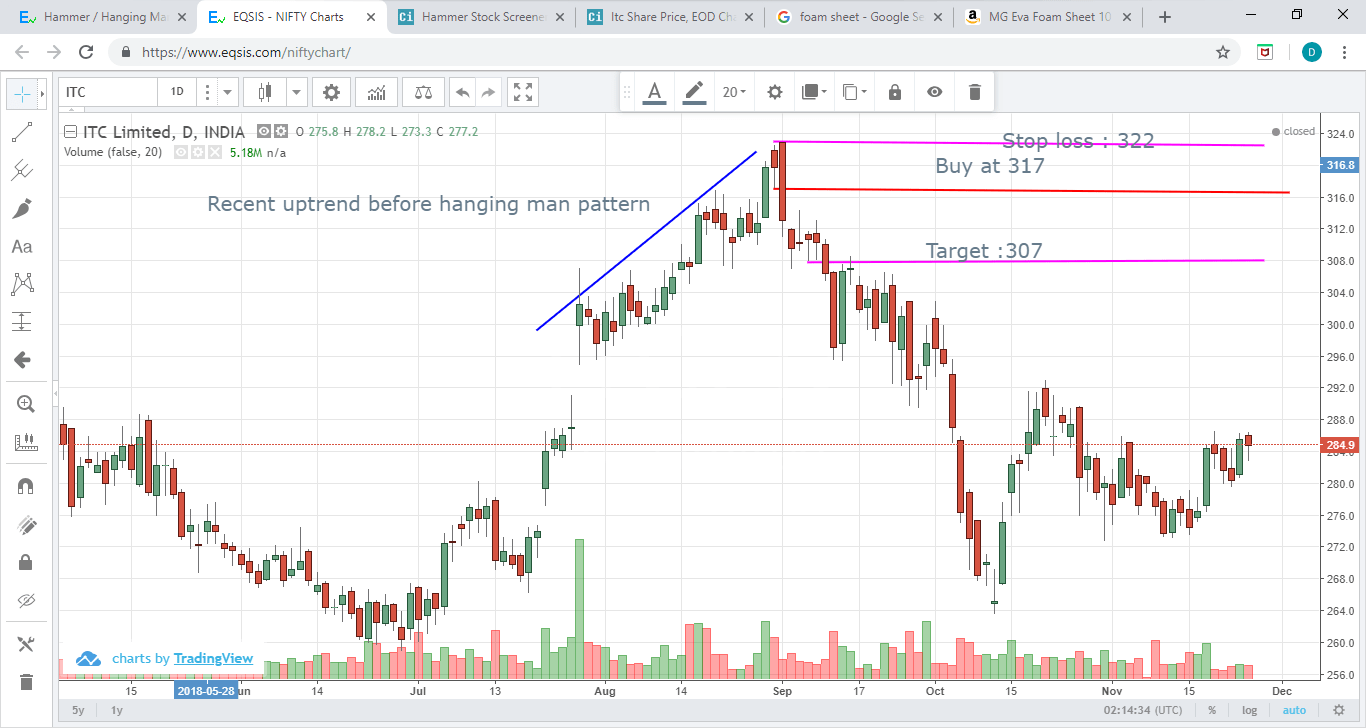

To successfully utilize this strategy, a trader needs to bid and offer on a specific stock simultaneously. This complicated move happens to profit on the spread between bid and offer, and it’s mainly attempted on big volume stocks that aren’t moving or experiencing significant price growth. In this article, we cover the scalping trading meaning and strategies. We’ll tell you how https://1investing.in/ it works, and how it’s different from other styles of trading, including examples of day trading versus scalping. The method, however, becomes illegal if it does not comply with rules and regulations governing the trades. Another one strategy that could be used not only in scalping but as well in long term strategies like day trading is pullbacks and breakouts of trendlines.

When executing so many trades, the trader must be comfortable with his trading routine in terms of suitable charts, execution methods, position management, etc. There are many trading terminals that allow customers to choose the handiest, feature-rich, and reliable one, therefore a broker should provide its users with a set of terminals to select from. Having a strong discipline and psychology is an obligation that a scalper has to obtain in case if he wants to succeed in trading. Strict entries and exits, as well as proper money management, have to be followed without any exceptions. The break of rules may lead to unaffordable losses so scalping is an acceptable strategy only for those who understand the risks and has self-confidence in their actions. It is not a rare fact when traders turn hundreds of dollars into hundreds of thousands on forex, stocks, and other asset types, which is proven by independent monitoring services.

What are some of the mistakes beginner scalpers can make?

Scalpers also do not have to follow basic fundamentals because they don’t play a significant role when dealing with only a very short timeframe. For this reason, traders don’t need to know that much about the stock. Forex scalping can offer many opportunities because the market is active round the clock. However, the best forex scalping strategy is to concentrate on major currency pairs such as the EURUSD, GBPUSD, and USDJPY. These pairs have sufficient liquidity throughout and can be traded with very low spreads.

This guide will examine scalp trading, otherwise known as scalping. It will present the reader with the five best scalping strategies, tips, and tricks for beginners, as well as the pros and cons of using this trading method. The most successful scalping trader should have been a day trader first. They must know the markets inside out and understand past, current, and future trends without fail. Leverage happens when a trader deposits only a small amount of the capital they’re buying or selling to open a position and trade. This smaller deposit is leveraged against the value of the entire share, so if the trade is successful, the return is much higher than the deposit.

Market-making is perhaps the riskiest of all scalping trading strategies. It requires a trader to have extensive knowledge and compete with experienced market managers in bidding and offering . The next suitable instruments for this trading style are stocks, mainly traded on American exchanges What is the relationship between the COD and BOD values in Waste water like NYSE and NASDAQ, being also very liquid and having a daily volume of billions of dollars. A trader who decided to stick to scalping has to have a strict set of rules that have to be followed because a single large loss can wash away the hardly gained profits from previous trades.

Trading 101: What is Scalping in Trading?

Frequent buying and selling are bound to be costly in terms of commissions, which can shrink the profit. The broker should not only provide requisites—like direct access to markets—but also competitive commissions. Traders who adopt this trading style rely on technical analysis rather than fundamental analysis. Technical analysis is a way to assess a stock’s past price movement. Traders use charts and indicators to find trading events and create entry and exit points. Scalpers buy low and sell high, buy high and sell higher, or short high and cover low, or short low and cover lower.

This allows traders to evaluate a company and manage risk for growing their wealth over time. Scalping is a trading strategy in which traders profit off small price changes for a stock. James Chen, CMT is an expert trader, investment adviser, and global market strategist.

Relative Strength/Weakness Exit Strategy

Each product within the market receives different spread, due to popularity differentials. The more liquid the markets and the products are, the tighter the spreads are. Some scalpers like to trade in a more liquid market since they can move in and out of large positions easily without adverse market impact. Other scalpers like to trade in less liquid markets, which typically have significantly larger bid–ask spread.

The trading strategies discussed in this article are complex and should not be undertaken by novice investors. Readers seeking to engage in such trading strategies should seek out extensive education on the topic. While the main trade develops, a trader identifies new setups in a shorter time frame in the direction of the main trade, entering and exiting them by the principles of scalping. A successful stock scalper will have a much higher ratio of winning trades versus losing ones, while keeping profits roughly equal or slightly bigger than losses.

- There are many scalping strategies that could be applied so everyone will definitely find some suitable ones.

- When Robin stated that he earned as least as much as she did, she challenged him to compute a day’s earnings and compare.

- Scalping is defined as a trading approach whose goal is to profit from small price movements.

- This is the opposite of the “let your profits run” mindset, which attempts to optimize positive trading results by increasing the size of winning trades.

In addition, it proposes that smaller moves are easier to catch than larger ones, as well as more frequent. If you want to learn scalping trading, we highly recommend that you seek out true market professionals who can offer you real-world examples and actual training scenarios. They’re more likely to gain better results with more positions open in a daily market, and the more they have, the better their chances, even if their wins are only half of their losses that day.

Cons Of Scalping

In addition to producing product that can be used on the construction project, the excess material can be trucked and old off the project. Stone, sand, etc. are very expensive products if the contractor is forced to purchase these materials. However, if the contractor can produce the material in lieu of buying it, the profit margin is expanded. A call option is a contract that gives the option buyer the right to buy an underlying asset at a specified price within a specific time period. Charles is a nationally recognized capital markets specialist and educator with over 30 years of experience developing in-depth training programs for burgeoning financial professionals. Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more.

But if the reading is under 20, it’s considered oversold and provides an entry point to buy. Market-making occurs when the scalper attempts to capitalize on a spread by posting a bid and an offer on the same stock simultaneously. However, this strategy only works on immobile stocks that don’t have price fluctuations and are traded at high volumes. While they share numerous similarities such as focusing on making multiple trades throughout the day and keeping the trade windows small, there are a few key differences. Scalping offers traders the opportunity to earn major profits, however, it requires traders to have discipline and a fair amount of experience in reading market trends.

Why use Scalping as a strategy?

A scalper is a trader who attempts to make profits from small price changes in the market. This means that they tend to place lots of small bets throughout the day and constantly monitoring the price levels of each trade. Discounting is a scalping trading strategy that aims for smaller profits gained through many open daily positions. The discounter strategy means an increase in winning positions sold quickly instead of letting profits accumulate throughout the day for a chance of better results. Trend TradingTrend trading refers to a distinct trading strategy that identifies and utilizes market momentum to earn profit.

This pips amount means a below-average profit amount if a safe lot size is used, that is why scalpers usually increase their volume sizes to increase the potential profits as well. That is why the majority of Forex scalpers prefer not to follow the usual 2% risk management rule. The other two styles are based on a more traditional approach and require a moving stock, where prices change rapidly. These two styles also require a sound strategy and method of reading the movement. Scalping requires discipline—once a set profit or loss has been reached, the scalper needs to exit the trade.

The spread can be viewed as trading bonuses or costs according to different parties and different strategies. On one hand, traders who do not wish to queue their order, instead paying the market price, pay the spreads . On the other hand, traders who wish to queue and wait for execution receive the spreads . Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. Scalping or scalp trading is a short-term trading strategy designed to profit from small price movements in an asset’s price. The method involves profiting from the volume of trades placed instead of attempting to gain the most on each individual trade.