Contents:

Brokers collect on the spread in pips between what price the seller receives and the price the buyer pays. Note that JPY pairs have two decimal places, and the pip is the second decimal place in this case. For every .0001 pip move in USD/CAD from the example above, your 10,000 unit position changes in value by approximately 1.24 NZD. So, for every .01 pip move in GBP/JPY, the value of a 10,000 unit position changes by approximately 1.27 USD. This means that the pip value will have to be translated to whatever currency our account may be traded in. Learn how to trade forex in a fun and easy-to-understand format.

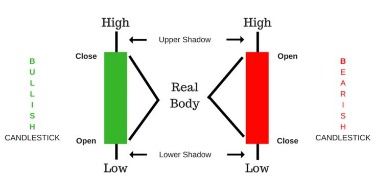

Before calculating the point value, we need to understand the quote’s meaning. You must understand that Forex trading, while potentially profitable, can make you lose your money. CFDs are leveraged products and as such loses may be more than the initial invested capital. Trading in CFDs carry a high level of risk thus may not be appropriate for all investors. The spread in a currency pair can be quoted in pips, as it is a measure of the market price movement. A pip can be defined as the equivalent of a ‘point’ of movement – at IG we measure currency moves in pips for CFD trades, but we refer to them as points.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Reporting trading results in pip amounts can make the most sense for a trader because of its simplicity.

Practice risk management

This bid-ask spread also represents the profit that will be made by the FX broker of a transaction if they are able also to find a matching transaction on the other side. However, the idea is the same, and many brokers now provide trading calculators that relieve the investors from the burden of calculating profit/loss by hand. Just visit the broker’s website, enter the product you want to buy and the expected entry and exit price, and the system will calculate for you. If you haven’t yet, read all about what margin, leverage, and drawdowns mean.

‘, let’s answer another question, ‘what is the meaning of pip? Some say that the “pip” meaning in Forex originally stemmed from Percentage-In-Point, but this may be a case of false etymology. Whatever the meaning of pip, they allow currency traders to discuss small changes in exchange rates in readily understandable terms. The next step in answering the question, ‘what are pips in Forex? ‘ and understanding the meaning of pips, is to understand how to calculate Forex pips.

Currencies Not Quoted to Four Decimal Places

It denotes the minor unit change in the price of a currency pair. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. In FX markets, the spread would be represented in the difference between these numbers would be the spread, measured in pips.

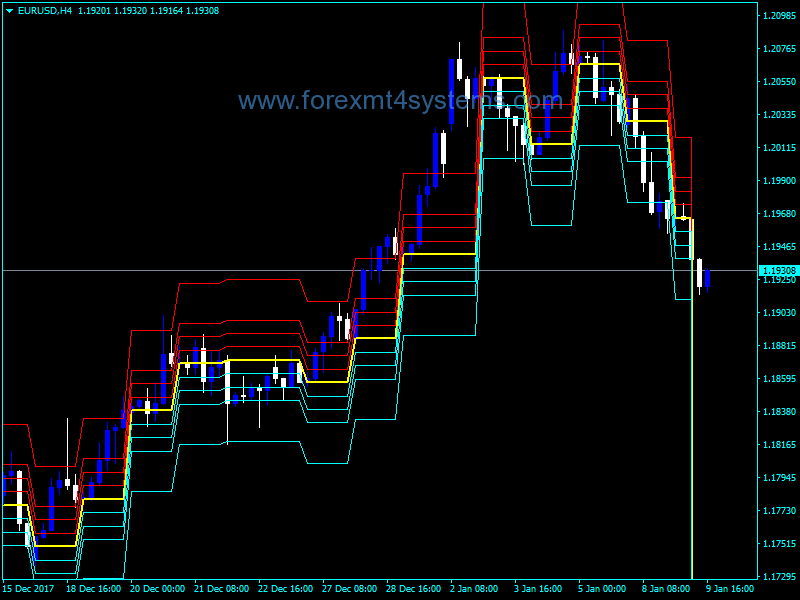

How to Day Trade the Non-Farm Payrolls Report (NFP) in EURUSD … – TradeThatSwing

How to Day Trade the Non-Farm Payrolls Report (NFP) in EURUSD ….

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

The concept of pips is very important in trading in order to understand how exchange rates move, how to calculate the profit or loss on a position, and how to manage risk effectively. However, many traders still lack a deep understanding of pips in trading and risk management, which puts a large burden on their trading performance. In light of this, we’ve provided a detailed guide on what pips are in Forex trading, how to calculate their value, what pipettes are, and much more.

Trading

There are thousands of forex commodities, and the contract size varies from broker to broker. Therefore, the pip value may vary, although it is the same Pip. This is for general information purposes only – Examples shown are for illustrative purposes and may not reflect current prices from OANDA.

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

In the following example, we will use a quote with 4 decimal places. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Another case in point is the Turkish lira, which reached a level of 1.6 million per dollar in 2001, which many trading systems could not accommodate.

Pips are used to calculate the rates traders in the forex market will pay. Understanding pips in Forex is a prerequisite to learning more complicated concepts in trading. One of these is the volatility of Forex pairs, which is often expressed in the number of pips that a pair moves during a day. Cross pairs usually have larger pip movements than major pairs over the course of a day, which can be ascribed to relatively low liquidity. A pipette represents the fractional of a pip, and has a value of 1/10 of a pip.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

Nowadays it’s easy and tempting to constantly compare yourself to others’ trading performances. But just because one dude from the forums is making pips rain doesn’t make you a lesser trader. A lot of traders mistake trading plans as a set of rules that may or may not be followed when executing a trade. Understanding the concepts of a pip and a pipette is required if you want to trade Forex. You will need to understand the meaning, the common jargon, and the ways to calculate pip value. When you start learning about Forex trading, one of the first concepts you will see is the concept of pip.

Many https://g-markets.net/ quote their spreads using exchange rates with five decimal places, meaning spreads are usually expressed using pipettes. For example, the spread on a major pair like EURUSD can be 0.7 pips or 7 pipettes, while cross pairs like AUDCAD can have a spread of 2.2 pips or 2 pips and 2 pipettes. If your account is funded with a currency other than the U.S. dollar, the same pip value amounts apply when that currency is the quote currency. For example, for a euro-denominated account, the pip value will be 10 euros for a standard lot, 1 euro for a mini lot, and 0.10 euro for a micro lot when the euro is the second currency in the pair. For pairs in which the euro isn’t the quote currency, you would divide the usual pip value by the exchange rate between the euro and the quote currency.

For most currency pairs—including, for example, the British pound/U.S. Dollar (GBP/USD)—a pip is equal to 1/100 of a percentage point, or one basis point, and pips are counted in the fourth place after the decimal in price quotes. For currency pairs involving the Japanese yen, a pip is one percentage point, and pips are counted in the second place after the decimal in price quotes.

Naturally, we also have to protect ourselves using risk management rules, and it begins with learning what a pip is on the Forex market. In currency markets, there is a difference between the price a trader pays and the price they receive—known as the bid-ask spread—it is a common forex trading technique. Similarly, when a trader makes a profit, it is expressed in PIPs. A pip is a unit of measure for price movements in foreign exchange (“forex” or “FX”) markets. A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair.

The pip value is defined by the currency pair being traded, the size of the trade and the exchange rate of the currency pair. To calculate pip value, divide one pip (usually 0.0001) by the current market value of the forex pair. Then, multiply that figure by your lot size, which is the number of base units that you are trading. This means that the value of a pip will be different between currency pairs, due to the variations in exchange rates. However, when the quote currency is the US dollar, the value of a pip is always the same – if the lot size is 100,000, the pip will equal $10.

Best Pairs to Trade in Forex in March 2023 – Business 2 Community TR

Best Pairs to Trade in Forex in March 2023.

Posted: Thu, 15 Sep 2022 07:00:00 GMT [source]

Learn to apply risk management tools to preserve your capital. There is nothing binding you to follow the plan and there are times where you feel that the trade won’t “work” if you stick to it. As a result, you take trades on gut feeling, making sudden adjustments, and deviating from the plan at the first sign of trouble.

That means that you originally sold $166,650, and ended up with $166,660, for a profit of $10. From this, we can see that a one-pip movement in your favour made you $10. By using the following two formulas, you can easily calculate how much profit or loss your position has generated with great precision. The effect of different position sizes on the value of a single pip is shown in the following table. Liquidity plays an important role in the pip-volatility of pairs, since a smaller number of buyers and sellers at any given price usually have a positive effect on volatility. That’s why exotic pairs, such as ones including the Mexican peso or Turkish lira, can easily move hundreds, even thousands of pips in a single day.

If your account is denominated in a currency that is different to the quote currency, it will affect the Forex pip value. You can use our Trading Calculator to calculate forex pip values and profits with ease. This information above covers most of the basics of the answer to, ‘what is a pip in Forex trading? Indicators based on pips like the ATR can also help you evaluate the risk involved in trading a currency pair.

what is the meaning of pip in forex risk management concepts to preserve your capital and minimize your risk exposure. Seek to understand how leveraged trading can generate larger profits or larger losses and how multiple open trades can increase your risk of an automatic margin closeout. In the case above, a pip is in the 1/10,000th place or 4 places to the right of the decimal. A Forex pip is an incremental price movement, with a specific value dependent on the market in question. Put simply, it is a standard unit for measuring how much an exchange rate has changed in value.